- XRP Price Exits Downtrend to Hit Three-Week High ;

- SEC Restarts Clock on Proposed ‘Bitcoin and T-Bills’ ETF ;

- Peter Thiel Backs $200 Million Valuation for Renewable Bitcoin Mining in the US ;

- Binance Futures Bucks ‘Dismal’ Volume Trend — Trades a Record $700M ;

*Grayscale: Q3 Saw Record High Inflows, Growing Institutional Interest ; - 🗞 Daily Crypto News, October, 16th 💰

- STEEM Trading Update

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 XRP Price Exits Downtrend to Hit Three-Week High

XRP has been on the offensive, having ended a 3.5-month-long downtrend with a move to three-week highs.

The world’s third-largest cryptocurrency by market capitalization clocked a high of $0.2993 Tuesday, the highest level since Sept. 21, according to CoinDesk’s price index.

As of writing, XRP has pulled back slightly and is changing hands at $0.2879, representing a 3.8 percent drop on the day after reaching its local peak.

Notably, prices are up more than 25 percent from the low of $0.2343 registered on Sept. 26. Further, XRP is the third-best performing top 10 cryptocurrency of the last seven days with a 2.2 percent gain.

🗞 SEC Restarts Clock on Proposed ‘Bitcoin and T-Bills’ ETF

The U.S. Securities and Exchange Commission (SEC) is again soliciting comments on a proposed exchange-traded fund (ETF) based around bitcoin and Treasury bonds.

According to a public filing published Tuesday, investment management firm Wilshire Phoenix and NYSE Arca filed an amendment to their ETF proposal earlier this month to address issuance and redemption for the securities and the listing/trading of the fund’s shares.

Coinbase Custody will act as the custodian for the bitcoin held by the trust, according to the filing. Tuesday’s notice says Coinbase will provide attestations confirming the amount of bitcoin it holds within five business days of the trust’s monthly rebalancing, adding a detail not present in the original filing.

The amended rule change proposal also notes that CME and Intercontinental Exchange (ICE) provide bitcoin futures products in the U.S., rather than CME and Cboe. The latter company wound down its futures product earlier this year.

🗞 Peter Thiel Backs $200 Million Valuation for Renewable Bitcoin Mining in the US

One company is driving its business plan straight into the “bitcoin wastes too much energy” argument and has raised $30 million to do so.

That’s according to Layer1 co-founder and CEO Alexander Liegl, which plans to bring wind-powered bitcoin mining rigs to West Texas early next year. The company is raising a total of $50 million at a $200 million valuation, he said.

The idea of bitcoin crowding out other uses for clean energy reflects a misunderstanding of the market, Liegl explained in a phone call:

“Renewable energy is still primarily under-utilized so you don’t actually have a zero-sum game.”

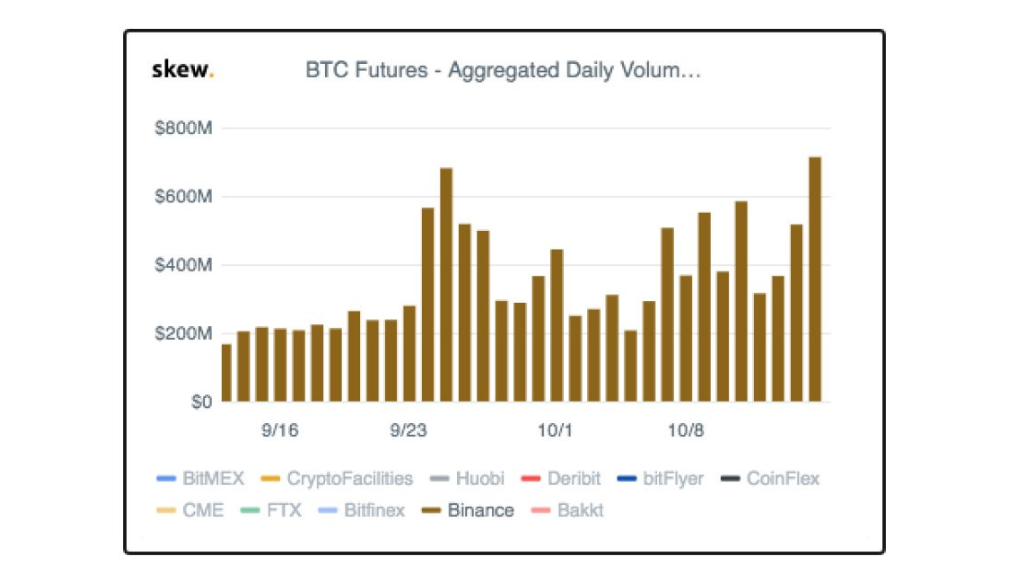

🗞 Binance Futures Bucks ‘Dismal’ Volume Trend — Trades a Record $700M

Binance’s Bitcoin futures product is the only winner in a lackluster market this week as trading volume hits local lows.

Research highlights “very low” activity

Analysis of various platforms’ trading volumes by exchange eToro’s senior market strategist Mati Greenspan on Oct. 15 revealed cryptocurrency markets had all but bottomed out in terms of activity.

From a peak of around $4 billion per day several months ago, Bitcoin (BTC) now sees less than $200 million change hands, he said referencing data from research outlet Messari.

Other players told a similar story, including derivatives giant BitMEX and P2P exchange Localbitcoins.

Futures providers likewise have not escaped; both CME Group and newly-launched Bakkt continue to see what Greenspan describes as “very low” activity.

🗞 Grayscale: Q3 Saw Record High Inflows, Growing Institutional Interest

Digital asset management giant Grayscale registered over $254 million in total investment into its products in the third quarter of 2019.

In its Digital Asset Investment Report for Q3 2019, Grayscale provided details on the inflows into its products for the period from July 1, 2019 through Sept. 30, 2019.

The third quarter of the year marked the highest demand for the company’s offerings since its establishment, resulting in $254.9 million of inflows. The figure shows a threefold quarter-on-quarter increase, from $84.8 million last quarter.

The quarterly inflows into Grayscale Bitcoin Trust amounted to $171.1 million, wherein July was the month with the highest level of inflows during Q3. As reported in July, Grayscale Bitcoin trust outperformed indices in the first half of 2019, up almost 300% on the year at the time.

🗞 Daily Crypto News, October, 16th 💰

- Qtum (QTUM)

"The mainnet hard fork is scheduled for Oct 16th!"

- General Event (CRYPTO), Quant (QNT)

Supply Chains Unblocked in London from 9:30 AM - 6 PM.

- General Event (CRYPTO), IOTA (MIOTA), Netbox Coin (NBX)

Blockchain Life 2019 from October 16-17 in Moscow, Russia.

- IoTeX (IOTX)

"The next evolution of IoTeX blockchain, secure IoT hardware, and decentralized identity is coming October 16 - mark your calendars."

- Selfkey (KEY)

"Soon, wallet users will be able to manage corporate profiles and identity attributes."

Last Updates

- 🗞 Daily Crypto News, October, 15th💰

- 🗞 Daily Crypto News, October, 14th💰

- 🗞 Daily Crypto News, October, 13th💰

- 🗞 Daily Crypto News, October, 12th💰

- 🗞 Daily Crypto News, October, 9th💰

- 🗞 Daily Crypto News, October, 8th💰

- 🗞 Daily Crypto News, October, 7th💰

- 🗞 Daily Crypto News, October, 6th💰

- 🗞 Daily Crypto News, October, 5th💰

- 🗞 Daily Crypto News, October, 4th💰

- 🗞 Daily Crypto News, October, 3rd💰

- 🗞 Daily Crypto News, October, 2nd💰

- 🗞 Daily Crypto News, October, 1st💰

Join this new Free To Play on the STEEM Platform !