- Why Did Bitcoin Break Down From $9,000, and Where Is It Heading? ;

- US Congressmen Ask Fed to Consider Developing ‘National Digital Currency’ ;

- Coinbase to Pay Users 1.25% Interest on USDC Stablecoin Holdings ;

- These Two Exchanges Might be the First to List Telegram's Gram ;

- 10 Main Trends in Digital Assets this Year, Picked by 5 Crypto Experts ;

- 🗞 Daily Crypto News, October, 3rd 💰

- STEEM Trading Update

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 Why Did Bitcoin Break Down From $9,000, and Where Is It Heading?

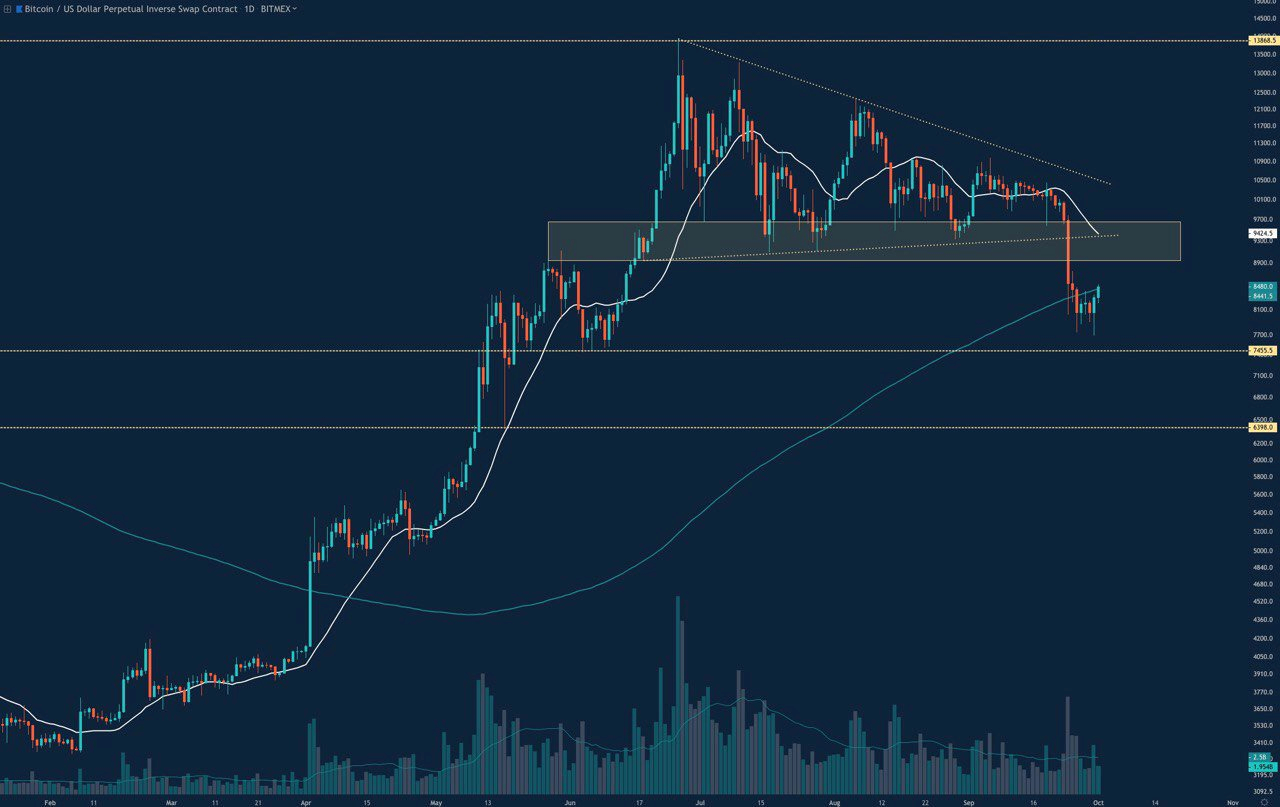

As Bitcoin’s (BTC) price floats in the waters of uncertainty in the low $8,000 range, one might wonder how crypto’s largest asset found itself at the bottom of a steep drop after its exuberant price rise from $3,330 to $13,880 earlier in 2019. One explanation could be that the move was simply the market’s reaction to a chart pattern many experts had their eyes on for months.

After its June 26 price high at $13,880, Bitcoin formed a descending triangle, followed by multiple months of consolidation. Near the end of the pattern the digital asset plunged from $9,700 to $8,000, a $1,700 drop in a single day. Bitcoin’s Sept. 24 tumble also occurred just one day after Bakkt launched its physically-settled Bitcoin futures product.

Following the sharp correction, prominent crypto analysts Ledger Status, Tone Vays and Crypto Cred, provided insights on Bitcoin’s wild price drop.

Ledger Status explains the market was due for action

According to crypto analyst and podcaster Brian Krogsgard, also known as Ledger Status on Twitter, Bitcoin was due for some activity. “The market needed a reason to move after three months of tight consolidation,” Krogsgard told CoinTelegraph.

During its breakdown, Bitcoin punched through an important moving average (MA), possibly accelerating the drop. “The breakdown was a break under the 20-week moving average, which in prior bear and bull markets has been a significant support and resistance line,” Krogsgard explained.

🗞 US Congressmen Ask Fed to Consider Developing ‘National Digital Currency’

Two U.S. lawmakers want the Federal Reserve to consider creating a digital dollar.

In a letter sent to Federal Reserve Chairman Jerome Powell, Rep. French Hill (R-Ark.) and Rep. Bill Foster (D-Ill.) outline concerns they have about risks to the U.S. dollar if another country or private company creates a widely used cryptocurrency, and ask whether the central bank is looking into creating its own version.

First reported by Bloomberg Law, the letter details how the Fed has the right to create and manage U.S. currency policy.

“The Federal Reserve, as the central bank of the United States, has the ability and the natural role to develop a national digital currency,” the

Congressmen wrote, adding:

“We are concerned that the primacy of the U.S. Dollar could be in long-term jeopardy from wide adoption of digital fiat currencies. Internationally, the Bank for International Settlements conducted a study that found that over 40 countries around the world have currently developed or are looking into developing a digital currency.”

🗞 Coinbase to Pay Users 1.25% Interest on USDC Stablecoin Holdings

You don’t have to be a trader on Coinbase to make a profit.

Starting Wednesday, customers of the San Francisco-based cryptocurrency exchange can earn interest on their holdings of the dollar-pegged stablecoin USDC. The annual percentage yield (APY) is 1.25 percent.

“We’re trying to build more ways for customers to grow their wealth on Coinbase,” said Coinbase product manager Paul Katsen, adding:

“One of the things we know is a bad customer experience is having to move your money back and forth from Coinbase to a bank account [to] earn a little bit of interest in the bank account. We’re trying to bring some of these experiences together but make them crypto-first and on Coinbase.”

🗞 These Two Exchanges Might be the First to List Telegram's Gram

Telegram has announced it will officially launch its TON blockchain network by the end of October – and has told investors how they can claim their Gram tokens. Media speculates that Blackmoon and DSX might be the first exchanges where investors can trade the new tokens.

Per an official release, the company stated that investors will need to generate a public key using a TON key generator, and provide a public key to the token issuer by October 16 to get their Grams. The company made no mention of what would happen should investors fail to meet this deadline. The TON Board also posted the TON source code on a GitHub page.

Telegram also sent out a more detailed letter about the launch to investors. Russian media outlet The Bell says it has seen the full text of this letter, and has spoken to two investors in detail about the TON launch.

🗞 10 Main Trends in Digital Assets this Year, Picked by 5 Crypto Experts

The Cryptoverse has certainly seen its fair share of trends over the years, both short and long-lasting. However, we wanted to find out from the industry’s experts what trends in digital assets they think are rocking the Cryptoworld this year.

Cryptonews.com had a chance to talk with the representatives of a few major companies in the field of cryptocurrency and blockchain, who attended this year’s Baltic Honeybadger conference held in September in Riga, Latvia. Based on their answers, we’ve compiled a list of 10 main trends in digital assets this year.

🗞 Daily Crypto News, October, 3rd 💰

- General Event (CRYPTO), Ethereum Classic (ETC), POA Network (POA)

ETC Summit in downtown Vancouver from October 3-4.

- NOIA Network (NOIA)

Noia Network hosts AMA on Facebook with the CEO and CTO.

- Fetch (FET)

"It's time for another Fetch AMA! Where: The Telegram channel of Vietnam Blockchain Community (VBC). When: 1pm UTC on Thursday"

- Aragon (ANT)

"The deadline to submit AGPs for the new mandatory community review period is in one month, on October 3rd."

- Next.exchange (NEXT)

The NEXT team will be approving additional users for phase 2 testing of their hybrid cryptocurrency exchange release.

STEEM Trading Update by my friend @cryptopassion

Here is the chart of yersterday :

Here is the current chart :

The steem is again in pause mode and should start a new move soon. We have very small candles, low volume and low volatility. It looks like STEEM and other altcoins are aware that we should have a new move on the BTC soon and that they are waiting the direction from the master. Will we brek the previous low and have a bounce in direction of the resistance line at 0.155$. The market will give us soon an answer... Let's be patient.

Last Updates

- 🗞 Daily Crypto News, October, 2nd💰

- 🗞 Daily Crypto News, October, 1st💰

- 🗞 Daily Crypto News, September, 30th💰

- 🗞 Daily Crypto News, September, 29th💰

- 🗞 Daily Crypto News, September, 28th💰

- 🗞 Daily Crypto News, September, 27th💰

- 🗞 Daily Crypto News, September, 26th💰

- 🗞 Daily Crypto News, September, 25th💰

- 🗞 Daily Crypto News, September, 24th💰

- 🗞 Daily Crypto News, September, 22nd💰

- 🗞 Daily Crypto News, September, 21st💰

- 🗞 Daily Crypto News, September, 20th💰

- 🗞 Daily Crypto News, September, 19th💰

Join this new Free To Play on the STEEM Platform !