I wanted to give another example of shorting the USD via BitShares and bitUSD loans. Please see my previous post for more details on how this works (along with the links within that post).

Since the price of BitShares has been going up quite a bit lately, I went a little bigger this time with a $3,000 bitUSD loan 9 days ago and bought bitShares with it.

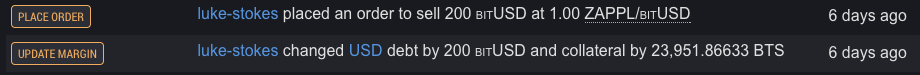

6 days ago when I heard about the opportunity to support @zappl by purchasing ZAPPL on OpenLedger, I went ahead and adjusted my debt by another $200 which got me 199 ZAPPL:

Today, I saw my collateral ratio sitting at a nice 7.51 (I started at 5.00) and decided it might be a good time to close things out:

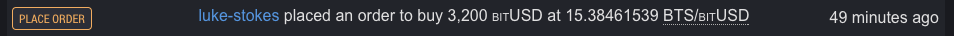

So I placed an order to buy up 3,200 bitUSD at $.065 per BitShare:

Once that hit, I had my bitUSD to pay back my loan.

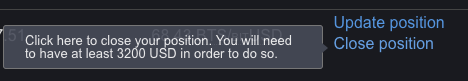

I simply clicked Close position in OpenLedger:

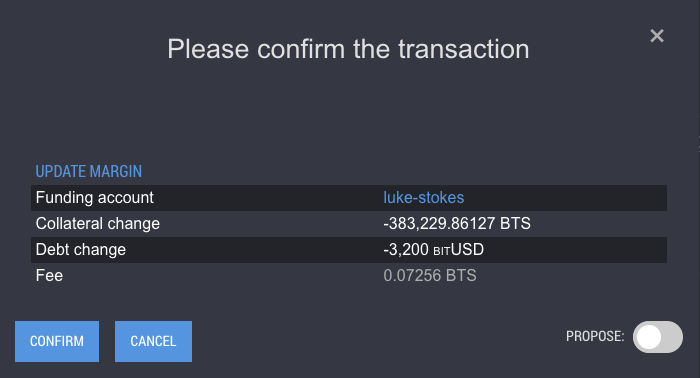

Entered my password and closed things out:

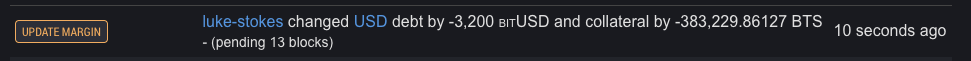

Which eliminated my debt:

So in just nine days, I got to support @zappl to the tune of $200 for free while also netting myself 19,821 BitShares which as of right now is worth around $1,225. Not bad considering I didn't do any real work here, and it didn't involve any additional investment of capital. I was simply using my own BitShare holdings as collateral to borrow bitUSD into existence via a smart contract.

Anyone can do this. Imagine if we all started shorting the value of the dollar against cryptocurrency using bitUSD and BitShares/OpenLedger?

Smart contracts are going to change the world. If you haven't yet, sign up for the EOS mailing list at http://eos.io/ to keep track of Dan Larimer's next project which is all about smart contracts via messaging.

Related Posts:

- A Simple Example of Shorting the U.S. Dollar With BitShares

- Playing in the Margins: bitUSD and BitShares on Open Ledger

- My Altcoin Investments: A Steemit Story

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.