Origin of BitShares - Part 15 -

Envisioning BitShares and Steemit as General Purpose Platforms...

BitShares and Steemit both sit on independent Graphene blockchain platforms and hope to attract other applications and businesses to build on their platforms. (See @dantheman's recent riff on Steemit's Evil Plan for World Domination, for example.) Yet BitShares and Steemit are themselves not sharing the same platform! They have apparently sacrificed the mind-blowing benefits I'm about to describe for other, more compelling reasons. PeerTracks and PeerPlays did the same thing. I feel like a surfer left in mid-air without a wave. What's going on?

AUTHOR'S NOTE: This is a update of an article I wrote in preparation for the Shanghai Blockchain Summit but didn't actually publish on BitSharestalk.org until March 9, 2016. At the summit, I was making the case to an auditorium full of people that we should be trying to consolidate platforms rather than following the current practice of proliferating a new one for each project. Here's the case I made back in that early Cyrptozoic Era - about a year ago. My point was that application developers should consider "surfing" from platform to platform as the technology improves rather that locking their applications forever into a increasingly obsolete technology chosen at the time they launched. This was, of course, cryptoheresy.

Nevertheless, I boldly suggested it during a panel discussion at that Shanghai Blockchain Summit in October 2015. We were each given the chance to end the panel with one powerful thought. The article that follows elaborates on the details, but here is the transcript of the brief recorded answer I made up on the spot:

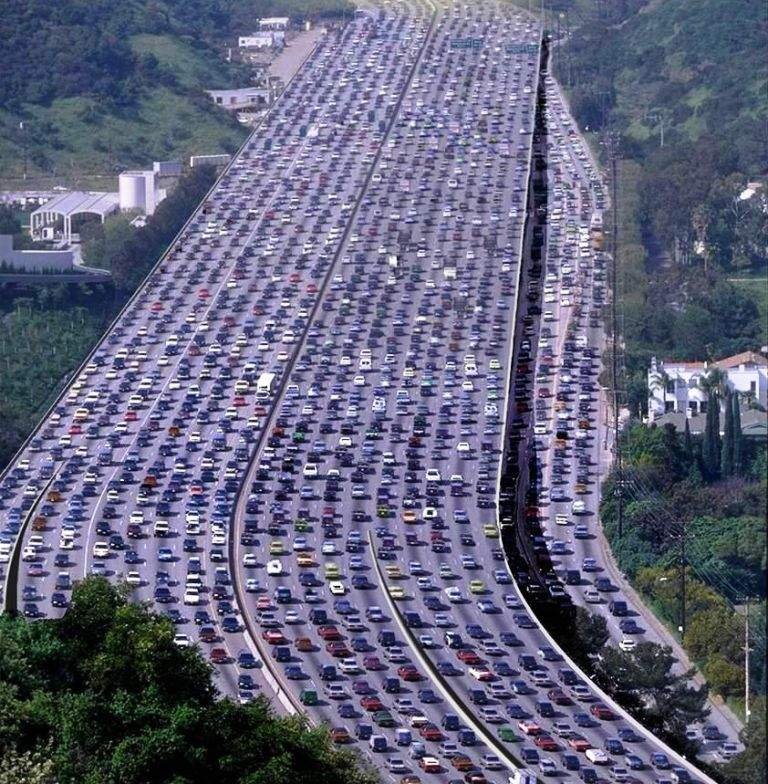

"I would just like to get across just the idea that every single asset shouldn’t live on its own island. There’s a reason why cities are as big as Shanghai, because when you put a lot of businesses into a common infrastructure with a common set of laws, the economy blooms. The number of economic interactions that can happen, the economic friction is so much lower inside an economic environment that has been put together. If you insist that each coin is going to sit on its own blockchain, every asset has to have its own blockchain, then you have lots of overhead, like traveling between islands to do business."

"I don’t advocate only one city. I like the idea of different cities with different rules, to do business in the one that suits where you want to be, but move your independent coins onto the best platform where you can do lots of economic interactions with them. That’s where we’re going to get the next generation of growth that we are stifled with now - to have to leave crypto and go to fiat every time you want to change islands."

Catch a wave and you're sittin' on top of the world....

There are many validations of the surprisingly elusive idea that it’s ok for a digital asset to switch platforms. Stellar started as a Ripple clone, developed its own platform and then jumped to it. NXT rolled its own version of Peercoin’s POS. Ethereum started on a POW platform with a pre-planned jump to POS. BitShares started as a POW surrogate called ProtoShares and has since jumped to DPOS and now to Graphene. Muse surfed from a BitShares hosted asset to its own Graphene chain. DASH has adopted DPOS. Even Steemit started out as, eew, Proof of Work before a pre-planned jump to Graphene. It seems many of the leading developers are getting jumpy!

Early coins were synonymous with the platforms they were built upon. In fact, some coins only came into existence because they were trying to offer a better platform. But, most altcoins simply cloned an existing platform and focused on their real mission:

based on a common philosophy, technology, developer, or meme.

Most such coins are imminently upgradable to better technology without losing what really matters – the brand and community that grew up around them.

Coins like Dogecoin ought to be leading this imminent megatrend. It is ideally situated as a “platform surfer”. The reasons its community loves it have little to do with the platform on which it resides. It ought to always be able to claim the very best technology and the most cost-effective performance because it has no particular technical axe to grind.

(And perhaps a dozen other things.)

And before our very eyes, that inertia is evaporating. As soon as the bulk of the world’s cryptocurrency communities realize that it’s easy and ok to change platforms, Katie bar the door! Everybody will be looking to use a platform upgrade as an easy way to move up the totem pole at coinmarketcap.com or avoid being passed by others. ...or not.

The Benefits

On many platforms you can launch a new coin in less than one hour and immediately have it listed on multiple exchanges with a rich set of on and off ramps already in place for you. And you don’t have to be a new coin. Any coin can upgrade. Instead of publishing the next incremental version of its existing software, it does a “pitch fork” (Pitch the old software while initializing same accounts and asset ownership on the new platform). Users switch wallets and voilà! Nothing else about the coin’s distinctive community or ownership structure needs to change, including its representation on coinmarketcap.com. This is exactly what we did for BitShares one year ago.

Even so, why should established applications bother to make the jump?

Given the Darwinian imperative of remaining competitive, applications should always be evaluating their choice of platform. Some of the top considerations are cost-effectiveness (a function of speed, bandwidth, operating costs), network effect (the number of users a platform has) and reduced economic friction (the ease of doing business with other players). Here, I’d like to focus on Larimer’s Fifth Blinding Flash of the Obvious:

Erecting a separate platform for each new asset

is like isolating your business on its own deserted island.

Its better to be co-located in a “big city” economy

where you can share services, infrastructure and market depth.

Of course, if your business is popular and unique enough, it may be worthwhile for people to "fly out to your island" to interact with you. But that’s still unnecessary economic friction. Moving your customer’s funds between exchanges or blockchains is like flying between islands. The associated delays, costs and limited local interactions inhibit what opportunities you can profitably pursue. This is the same reason car dealers, restaurants, and high-tech firms tend to cluster together with their competitors and suppliers to attract customers. Reduced economic friction.

choosing the city (or island) that will best support your business.

Ethereum offers an environment that will attract developers to populate its ecosystem with innovative applications. It might be viewed as the "Silicon Valley" of blockchain ecosystems. BitShares aims to be New York City, where transactions take place at New York economic speeds. Muse, a platform supporting custom coins for every artist, athlete, and political celebrity, offers an ecosystem more like Hollywood. I wonder what city Steemit might be most like. For what demographic does Steemit need to provide low-friction interactions?

Choosing your ideal economic platform.

So we are looking for platforms that are designed to be general-purpose ecosystems that support frictionless economic interactions between many complementary and competing players. Early platforms only needed to support the needs of a single currency. There was no thought given to facilitating efficient interactions with other products and services. Most coins relied on external privately owned exchanges for that purpose. But proprietary stovepipe exchanges are themselves islands, with their own barriers to getting between them and their own internal regulatory and security friction.

The best economic platforms, whether cities or block chains, are designed to minimize this friction. They are “superconductors” reducing economic resistance for transactions of every kind. They provide instant access to common services and infrastructure that can take years to build out on your own island. They provide instant teaming with other service providers without having to negotiate individual deals. Each new arrival enriches the set of services and products available for everyone else to build on.

Blockchain based platforms designed to do the accounting ledgers for many assets and applications at the same time can be thought of as many chains woven together into one compound chain. Counterparty-free atomic cross-application trading is built in! Smart contracts between member “chains” are completely frictionless.

That’s like saying my individual car doesn’t need the bandwidth of a 24-lane beltway to get around well in a big city. You do if you want to share that resource with a lot of other people – which is the whole point of moving to the Big City in the first place.

You also want to be on a fast platform so that a lot of other applications can join you there. In particular, so that applications that do need speed can thrive while serving you. A good example is day traders. They need the fastest possible trading times so they can exploit their specialized knowledge and tools. They will gravitate to the fastest platforms and, in turn, will generate the liquidity, market depth and specialized services that your application probably does need.

Speed is only one reason to upgrade.

Each platform will give your application a wealth of new features for free. I won’t attempt to represent them all, but here’s a sampling of the ones you can read about at BitShares.org. Each platform will have its own set of features you can inherit to make your own project more successful.

- Price Stable Cryptocurrencies – SmartCoins

- Decentralized Asset Exchange

- Choice of Public or Private Transactions

- Recurring and Scheduled Payments

- Referral Rewards Program

- Dynamic Account Permissions

- Transferrable Named Accounts

- Stakeholder Approved Project Funding

So why did we wind up with so many separate Graphene platforms?

That, my friends, is a great reason to watch diligently for my next post!

Cheers!

Stan Larimer, President

Cryptonomex

The Godfather of BitShares and Steemit

Coming up Next: Part 16 - Developer Freedom Trumps User Convenience

Previous in the Series:

The Origin of BitShares Rides Again (Parts 1-10)

Part 11 - It Is Very Cold in Space

Part 12 - Never Let Them See You Sweat

Part 13 - Cryptonomex Rears Its Head

Part 14 - The Jump to Light Speed

About the Author -- Stan Larimer

Follow Me On Steemit - The Social Media Platform That Pays

Please Connect To Me On Linkedin!

Greatest Hits

Bitcoin and the Three Laws of Robotics

Engineering Trust with Charles Hoskinson

The Origin of BitShares

Why I will never give up Christianity