This past weekend the whole cryptocurrency space lost around $40 billion dollars which represents about a 20% pullback. It could have been caused by the China ICO scare (which now appears to be more of a temporary stop until regulation gets put in place instead of an outright forever ban). It could also have been triggered by some whales with deep pockets who understood the three-day holiday weekend means those wishing to buy crypto won't be able to get their fiat money in quickly, so if they drive the price down with massive sell orders, they can turn the market and buy up more cheap coin before the banks reopen. It could also just be a normal correction based on the massive bull run we've had this year.

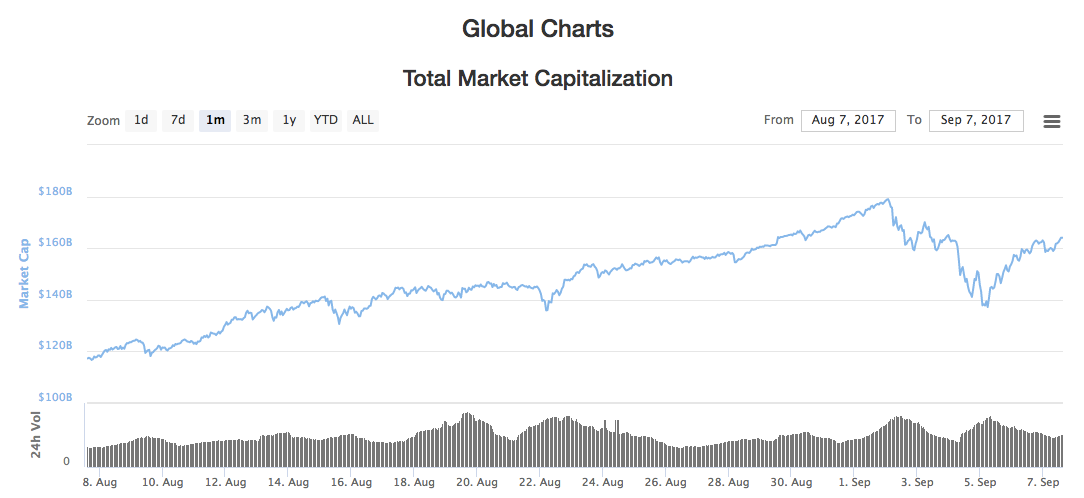

As I was thinking about it this morning, I took a look at the marketcap chart for the last month:

That 20% pullback that so many people were freaking out about... looks like a small blip. We've already recovered more than half of what was lost!

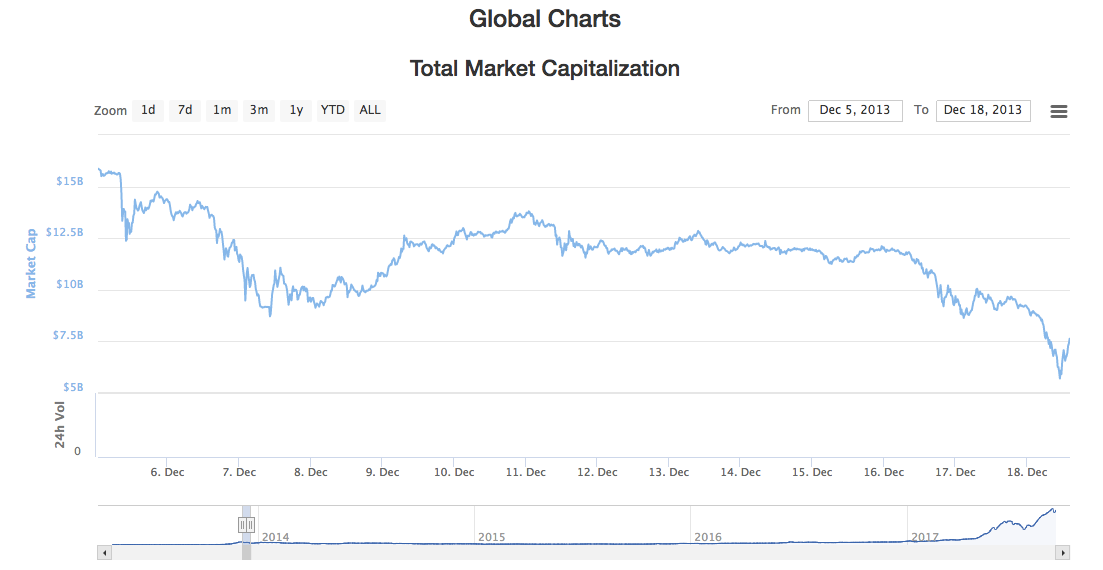

I've been involved in bitcoin since early 2013. Many others were involved even earlier. There's been an ongoing discussion about how an increased total marketcap will decrease volatility. When people see swings of $40B in a weekend, it's understandable to think that's crazy talk. However, when you think about it in terms of percentages, I don't think it is. Compare, for example, what happened in the end of 2013:

That was over a 60% drop in less than two weeks! I remember it clearly because I didn't sell. I HODL'ed. Yes, I could have sold and bought back in, but often things go up faster than they go down, and if you can't time it right (and very few people can, consistently) you end up losing more value than if you just held. Because I held, I was able to pay off my house this year.

So that brings me to my main question for you:

Are You Waiting to Buy Cryptocurrency?

Are you waiting for a big pullback? Are you second guessing buying in because "You could have bought when it was so much cheaper"? Are you letting psychological quirks like loss aversion keep you out of the game? What if this past weekend was your last best chance to buy in cheap?

I think there's a better way than constantly second guessing yourself or being concerned with the daily price. Instead, work your ass off to get out of debt, get some liquid savings together including diversified traditional retirement investments, and then free up some money to invest. Then, when you invest, do so rationally based on arguments you can get behind for the long-term.

When I first bought bitcoin, articles like this really impacted my thinking:

The Target Value For Bitcoin Is Not Some $50 Or $100. It Is $100,000 To $1,000,000.

That was written by @falkvinge in 2013, and I still think his argument is sound. He was right on the money with his 1000x return claim six years ago. He was thinking long-term.

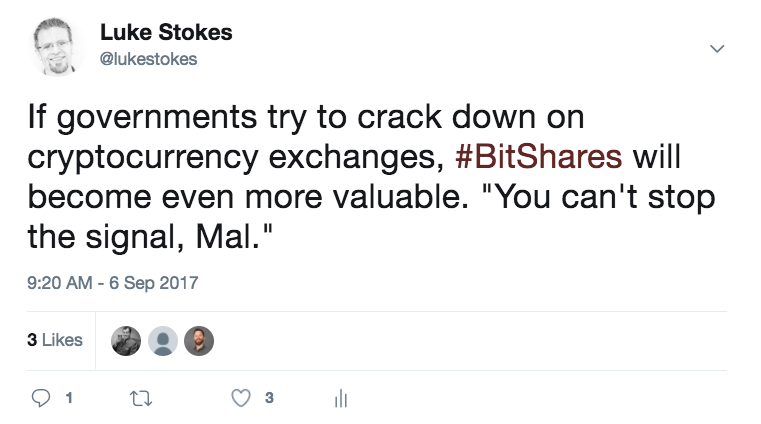

So for me, it's not about small gains here or there, buying and selling with each dip or bump. To me, it's a rational course of action to transition into the new cryptocurrency economy uncontrolled by governments and freely traded by individuals as they see fit. Yes, there will be regulatory battles and issues with privacy and control. That said, I'm confident the free market of ideas and technological advancement can and will stay a step ahead of bureaucrats and regulators. They will do so by innovating new truly anonymous cryptocurrencies as needed (and many already exist today).

No one can predict the future, and it's still very possible we could see another major crash. That's where the whole "Don't invest more than you can afford lose" advice comes in. Also don't invest if you might be tempted to pull money out at the wrong time because of an unforeseen expense. Your car will eventually break down. Your roof will eventually leak. Your AC unit will eventually need replacement. These aren't unexpected events, they are things we can and should plan for. Your cryptocurrency holdings, if you can manage it, should stick around long term if you really want to change your financial life.

I'm not an expert. Don't act on my advice but learn on your own. I blog about my own irrational trading moves. That said, I'll continue to share my opinions and stories because when we combine enough stories together from various sources, we can hopefully gain some knowledge.

Related post from 3 months ago:

The Big Question: Should You Sell or Hold During a Market Correction

I've heard some say you shouldn't buy any cryptocurrency you're not willing to hold for at least two years. What do you think?

Personally, I think cryptocurrency projects like STEEM and BitShares which have active development going on and provide a very real service (not just a promise of a service sometime in the future) are great buys. That's why I'm highly invested in them.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com