Here's another reminder both to myself and to my readers to view cryptocurrency ownership as a long-term investment in the financial system of the future instead of a short-term speculation.

I wrote this post on May 25th: The Big Question: Should You Sell or Hold During a Market Correction, and it applies today as well.

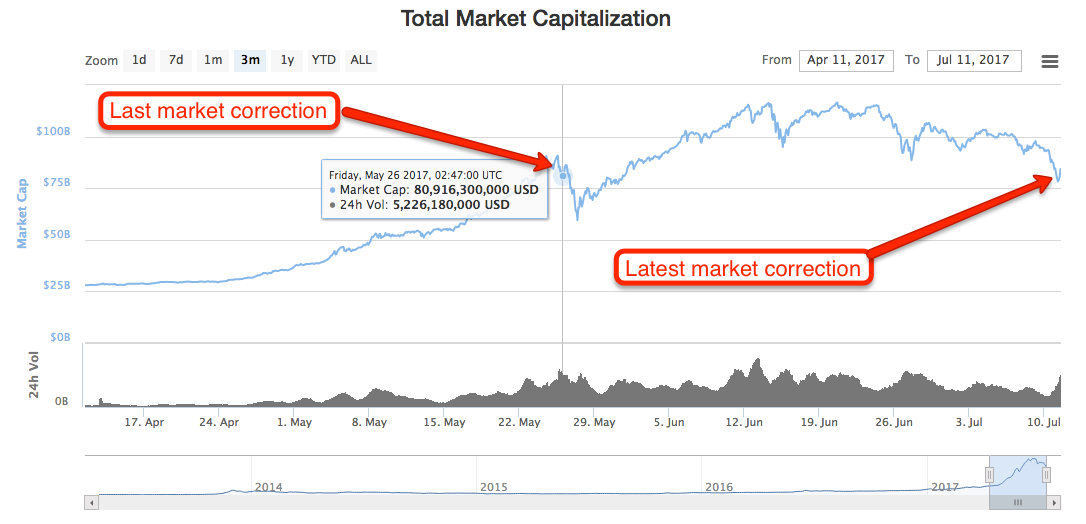

Here's the total market capitalization at that time along with the market cap today:

As you can see, even with this massive correction, we're still trending upward over the long-term. My portfolio is down 50% since 2017-06-13, but up 390% since 2017-03-27. As I've mentioned before, I purchased my first bitcoin in 2013 at $20 each. I watched bitcoin go all the way to $1,200 and then crash down to around $250. I didn't sell. Because I didn't sell, I was later able to pay off my house.

This, I think, is the difference between those who accumulate wealth and those who are living paycheck to paycheck. If you have no "extra" to invest, then you may be forced to liquidate when you need funds instead of when you'll get the best returns. Getting out of debt is key along with increasing your income to build savings. The Dave Ramsey baby steps are a good place to start.

It's easy to get frustrated with cryptocurrency investing if you start your investing at the end of a bull market and only experience losses. Keep in mind, those losses are only "on paper" and not realized until you actually sell. If you can hold, it's usually a good plan (unless you're way better than me at timing the markets to get in and out perfectly to increase your holdings).

Many are promised great riches and "lambos" (Lamborghinis) falling from the sky to their own private island in a matter of days or weeks. That's not how reality works. Yes, some people get incredibly lucky, but they are the outliers. The crypto space has a lot of whales who will gladly squeeze margin positions and "weak hands" out so they can pick up cheap coins to further increase their wealth. This is how the game is played.

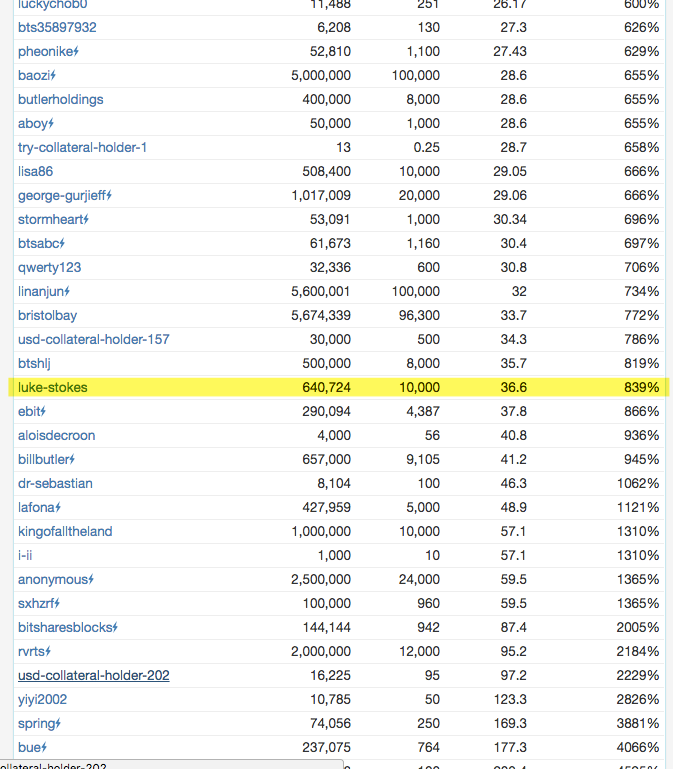

I posted recently about how my HERO margin was called. I also have an open margin with bitUSD, but this time, I hope, I can hold it until the market recovers. I'm watching the cryptofresh BitShares block explorer closely, specifically the "USD Debt Positions (Call Orders)" section. My Collateral Ratio is currently over 800% as you can see here:

Many others, I think, will be squeezed out and their holdings will be liquidated in the waiting hands of whales increasing their stacks. Others will sell for a loss due to fear of losing their principle. Those who win long-term will buy the dips.

Long story short:

- Get out of debt and build savings so you have extra to invest.

- Only invest what you're willing to lose.

- Think long-term.

- Lambos for everyone is not reality. Live in reality.

- HODL.

Don't take investment advice from random blog posts on the Internet, but continue to grow and learn from multiple sources to figure out what works best for you.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com