If you have more than $1,000 dollars in savings right now, you're already in a better position than about 35 percent of US adults.

Recent surveys from 2016 found that most adults in the US have very little money in their savings account. One survey by GOBankingRates found that only 15 percent had $10,000 or more in savings. About 11 percent only had between $1,000 and $4,999 in savings. The average savings for families, who had earners that were between the ages of 50 and 55 years old, was seen to be about $8,000.

Many Americans have reported that one of their biggest regrets in life, financially speaking, was that they didn't prepare sooner for their retirement. One survey by Bankrate found that about 46 percent of adults feel that they should've put more aside for things like emergency expenses and education for their children. It's also common that many feel as if they underestimated their retirement needs and weren't realistic in considering things like healthcare costs and more.

No doubt there are millions of Americans who plan on solely relying on Social Security in order to get by. However, for those who already rely solely on these funds, as opposed to supplementing their income with it, they will be eager to tell you of the hardships that such a fixed income might pose.

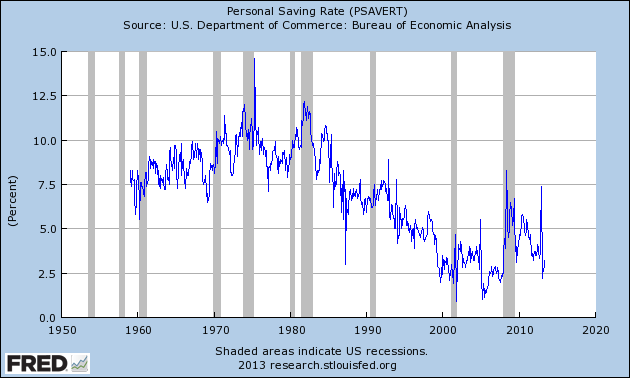

The personal savings rate, as a percentage of personal disposable income, is worrisome to some industry experts; the average is now seen to be about 5.1 percent. In other words, for every $100 of income, about $5.10 is being funneled toward things like emergency expenses, retirement, and so on. As you can see from the graph above, it used to be a lot higher than the average of around 5 percent.

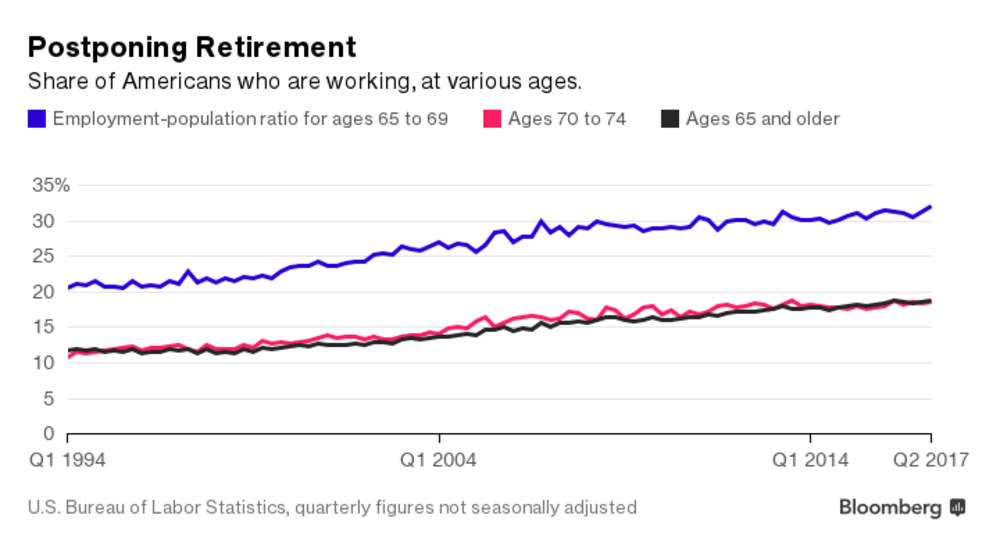

Seniors in the US are also seen to be working at the highest rates in 55 years, according to reports from Bloomberg. It's believed that many Americans might end up working past the age of 70, in order to pay for and meet their basic needs. According to a 2017 US jobs report, depending on how seriously you want to take them, roughly 19 percent of those aged 65+ were seen with part-time employment, for the second quarter of the year.

It's estimated that by 2024, for those who are between the ages of 65-69 ,that about 36 percent will be actively participating in the labor market.

Compare that 36 percent to that which was seen back around 1994 which was only said to be roughly 22 percent who were actively participating in the labor market between those ages.

It's also expected that workers will continue working well past 65 not only in the US but in other countries as well. For the US and Japan alone, about a third of the workers are expected to be working well past 70 years of age. Some even suspect that they might never be able to retire and that so long as they are living that they will need to continue working in any way that they can in the labor market.

Researchers point to a number of reasons for the trend, such as increasing life expectancy and improvements in healthcare.

For many Americans, they still expect that in the years to come that they will be able to supplement their needs by adding on a side income and working well past 60 or 65 years of age.

One survey by the Employee Benefit Research Institute found that about 79 percent of US workers say that working a side job is their retirement plan. However, this option poses a risk for those who neglect planning now for hopes that they can secure some potential suitable employment decades down the line.

The segments of the US labor force that are expected to show the most growth between now and 2024, are those 65 years to 74+ years old.

Pics:

Getty Images via US News

FRED

Bloomberg

The Office via Giphy

This is not intended to be taken as financial advice and is posted for information purposes only.

Sources:

http://www.cnbc.com/2017/06/13/heres-how-many-americans-have-nothing-at-all-saved-for-retirement.html

https://fred.stlouisfed.org/series/PSAVERT

http://fortune.com/2016/06/22/aging-workforce-retirement/

https://money.usnews.com/money/personal-finance/mutual-funds/articles/2015-12-16/9-tips-for-investors-getting-a-late-start-on-retirement-savings

https://www.fool.com/investing/2016/10/03/heres-the-average-americans-savings-rate.aspx

https://www.fool.com/retirement/2017/07/10/75-of-americans-underestimate-their-retirement-sav.aspx

https://www.bloomberg.com/news/articles/2017-07-10/working-past-70-americans-can-t-seem-to-retire

Related Posts:

Consumers Not Ready To Trust Robots With Their Savings

@doitvoluntarily/consumers-not-ready-to-trust-robots-with-their-savings

Biometric Payment Solutions Growing In Popularity With Consumers

@doitvoluntarily/biometric-payment-solutions-growing-in-popularity-with-consumers