Visa recently released a report on research that they conducted in order to investigate the prevalence of acceptance for biometric solutions in the market.

The act of scanning our face or our finger for verification is becoming more popular with consumers and a growing number are turning to embrace this payment method and this sort of technology in the market.

Biometrics are becoming more mainstream and they might come around faster than we think. It might not be very long before we soon see biometric solutions as the prevailing payment option in the market.

It wasn't that long ago that Mastercard announced its own efforts to get further into the space, by introducing a card that allows consumers to link their fingerprint with their credit card. Now when consumers go to pay for their goods, they have the option of simply scanning their finger print rather than typing in any code.

It's suggested that biometrics could be used to replace your entire wallet.

And a growing number of consumers are embracing this option of payment because they see it as being the more convenient option. No doubt there are many people who would much rather opt for the convenient payment method of scanning their finger, hand, eye, or face, than scrambling to remember a variety of identification and other cards.

At first, it's said that most consumers weren't very willing to rush to embrace the idea of biometric payment options. But as more airports have started to incorporate this technology into their screening process, a growing number of consumers are said to be growing more comfortable with it. Companies like Apple and Samsung also helped to boost acceptance by offering their users the option to scan their fingerprints in order to access their device. You can find it being used now by optometrists, hotels, and various other places.

A number of retailers are looking to incorporate biometrics into their process, using it to provide more individualized products or services to consumers.

Mastercard isn't the only one with a biometric card, as Visa has come out with their own effort known as the Verified-by-Visa program which includes fingerprint authentication. Consumers will simply be able to scan their fingerprint in order to make a purchase within the app while shopping online. HSBC and others are also looking to do the same, offering their customers biometric authentication.

It's estimated that 73 percent of consumers have confidence in biometric payment solutions.

This means that a lot of people in the market think scanning their finger is just as safe of a payment option as using a pin or a chip. A great deal of consumers seem eager and like they are looking forward to accepting this sort of payment option.

Biometric mobile payments are expected to surpass $2 Billion this year.

This estimate is according to Juniper Research. And that $2 Billion market is a fair increase from the amount that was seen in the previous year, it was around $600 million in 2016.

Biometric payment options are regarded by many as the superior option given that they are cost-effective and supposedly “highly-accurate,”. But there is still a lot of room left for acceptance to grow surrounding biometric solutions. However, that acceptance might grow very quickly.

Are There Any Concerns?

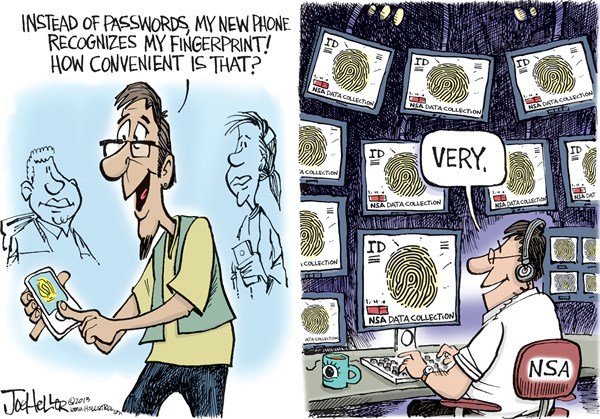

There are plenty of security, safety, and privacy concerns, pertaining to the use of biometric authentication and payment systems. Are they fail proof or immune to being corrupted? Of course not.

If your biometric data becomes compromised, it could turn into a nightmare to sort things out. Databases are frequently hacked and who is to say whether the biometric data would always be safe or not; that cannot be known. Also, it might be easy for someone who knows what they are doing to be able to access something like your fingerprint in other ways, and use other tricks to gain access. Despite there being some concerns though, many professionals still insist that this method of authentication is highly secure.

Pics:

iStockphoto/Getty Images

Pixabay

Joe Heller

Sources:

http://www.essentialretail.com/news/article/5911b01be471e-rbte-2017-consumers-increasingly-embracing-biometric-solutions

http://www.marketwatch.com/video/sectorwatch/how-biometrics-could-replace-your-entire-wallet/B51BB730-1E18-42B4-83AF-14093209F11D.html

http://www.techrepublic.com/article/biometric-mobile-payments-will-hit-2b-this-year/

http://www.itproportal.com/features/has-biometric-banking-finally-arrived/

https://theintercept.com/2017/03/22/real-time-face-recognition-threatens-to-turn-cops-body-cameras-into-surveillance-machines/

https://www.scientificamerican.com/article/biometric-security-poses-huge-privacy-risks/

https://www.wired.com/2016/03/biometrics-coming-along-serious-security-concerns/

Related Posts:

Mastercard Looking To Link Your Fingerprint To Your Credit Card

@doitvoluntarily/mastercard-looking-to-link-your-fingerprint-to-your-credit-card

Biometric Payment System Coming To India

@doitvoluntarily/biometric-payment-system-coming-to-india

Researchers Suggest Mobile Biometric Security Systems Might Be Easy To Trick

@doitvoluntarily/researchers-suggest-mobile-biometric-security-systems-might-be-easy-to-trick