Regular daily update on BTC ta analysts opinions.

**My summary - short-term sentiment: neutral ** (last: neutral)

- Move up was short lived. We moved back to 9'000 area. If that doesn't hold we probably going down significantly.

- Support is around 8'900, 8'700, 8'500 areas (see details in summary table).

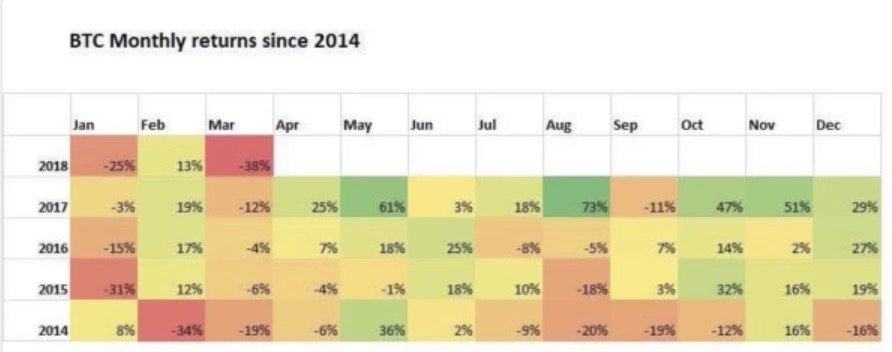

- Just realized I have been ahead of time. May is usually a strong month. Lets see how it plays out in 2018.

News about the blog

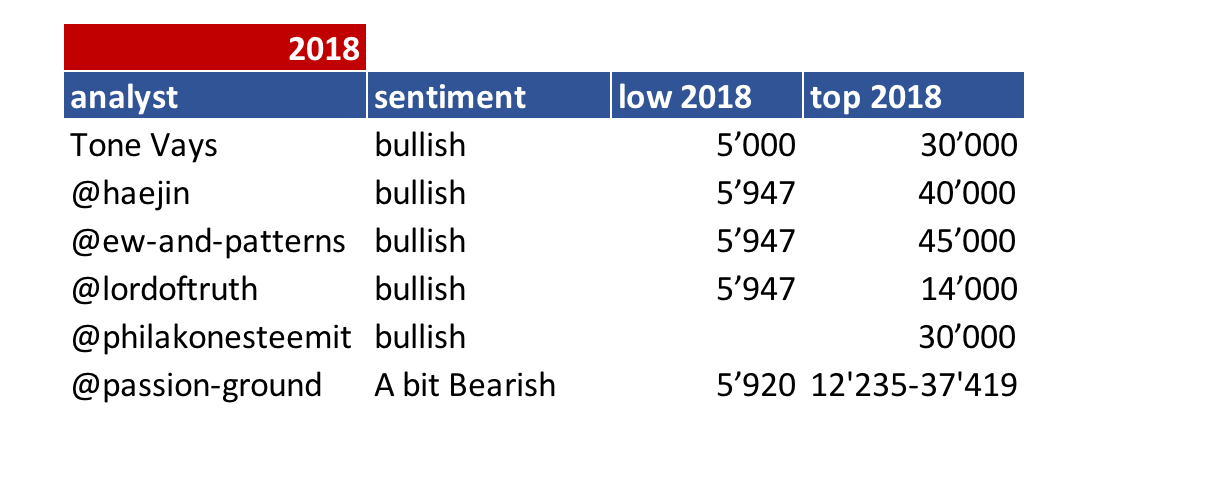

I need to revise my 2018 long term table. I need to add a 2018 and 2019 target an be more precise on the sentiment here. Will do that after I am back in Switzerland.

We lunched the bounty project beta. If you are interested and you like to create a bounty on your own have a look at this post

Analysts key statements:

Tone:

- Weekly: No update and still valid: Second week in a row we got rejected by the 30 week MA. Also a fib line is giving resistance. We are on a 4 of 9 and 8 of 13.

- Daily: No update and still valid: We have a A13. Got rejected by 200MA. He still thinks we are going down.

- 1H: We are moving down in waves. We have an OBV divergence which suggest we are taking out last low at 8'719.

@haejin:

Bitcoin (BTC) is working on the symmetrical triangle pattern. The ABC ZigZag correction remains but the waves have been updated to reflected the lower low that BTC put in.

@ew-and-patterns:

There is a possible alternate that white wave 4 still in progress.

Main count still remains the current one. We might be in wave 2 - next 48hours need to bring appreciation in value.

@lordoftruth:

A deep retracement based on 4H Butterfly and 1H 3-Drive is expected and most likely the retracement will be on Waves towards: 8'832, 8'573, 8'367, 7'770.

If bitcoin is holding above 9'038 this will push the price up towards 10'158 before the fall and will not cancel the retracement.

Todays trend is bearish. Expected trading for today is between 9'038 and 10'158.

@philakonesteemit:

We see a massive rejection at 10'000 range and have now hit a 0.618 golden ratio fibonacci retracement level. I do not believe it'll hold and we can see 9'050 to 9'150 range. If that doesn't hold we go for 8'200 to 8'620 range.

@passion-ground:

May is a Fibonacci turn-month (+/- one bar), and as such, it appears that May or June could mark a short to an intermediate-term high of sorts in the grander scheme of things. The next Fibonacci turn-month (+/- one bar) occurs in August.

The 50% advance from the April low appears constructive, bullish, and impulsive by every measure.

Be that as it may, there are indeed viable bearish alternate counts that must be taken into consideration despite this recent bullish move higher.

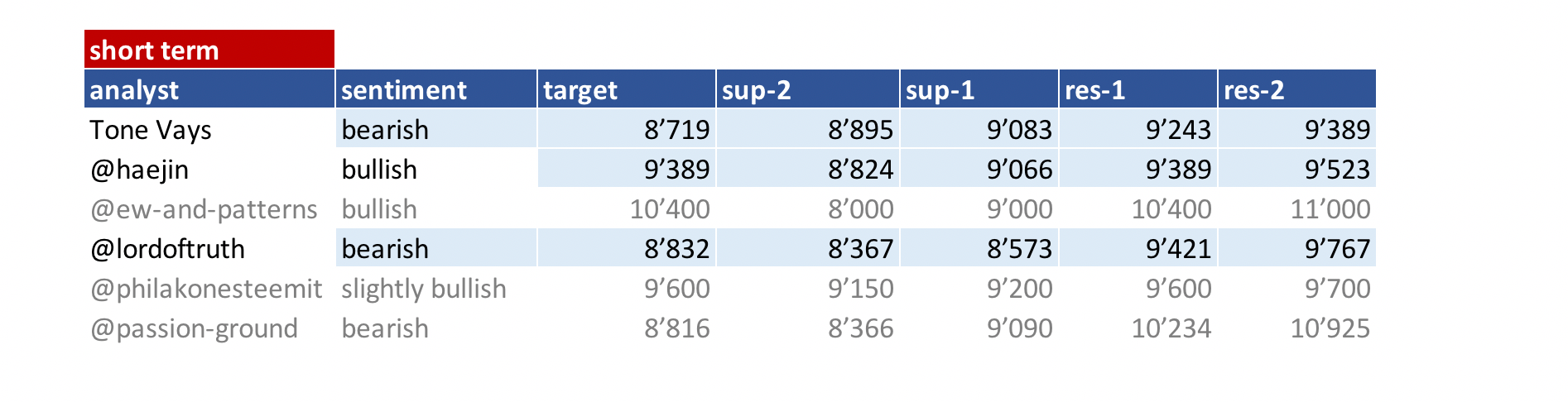

Summary of targets/support/resistance

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 09. May | here |

| @haejin | 08. May | here |

| @ew-and-patterns | 07. May | here |

| @lordoftruth | 09. May | here |

| @philakonesteemit | 07. May | here |

| @passion-ground | 07. May | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

- bottom = -> now renamed and moved to long term table. Low 2018

- low/top 2018 = what is the low or the top expected for 2018?

Further links for educational purposes:

- From @ToneVays: Learning trading

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here

- From @lordoftruth: Fibonacci Retracement

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.