Time: 8.46 A.M. / GM+2 / 30 Apr 2018 – Mon.

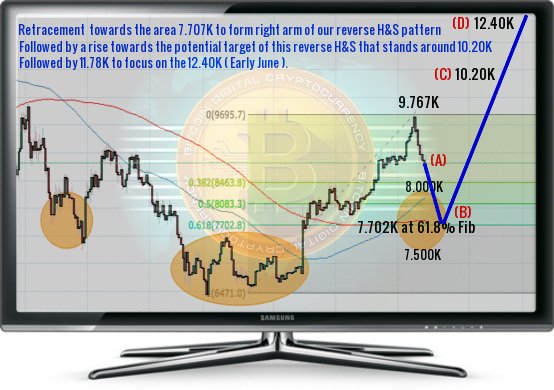

Bitcoin price now resumes its trading below 9.45K barrier, reinforcing the expectations that down is the direction in which the price will move, as we just saw again a potential move towards 9.767K, which was promptly invalidated and it is visible on the chart that 9.767K most likely is the local top of April, as we expected on 24 April in our post / 572 /.

Scaling Bitcoin has been a pretty big problem for several years. It now appears we may finally see proper improvements in this regard:

The lightning technology solves a lot of problems, although further developments are still warranted.

The positive regulatory changes and provides more legitimacy to this industry. Proper regulation will attract institutional investors at some point. So far, George Soros and the Rockefellers have made their Bitcoin investment strategy pretty clear.

While the long-term picture is positive, the short-term volatility remains. The reason why the Invetors / Traders attempt to use the volatility to thier benefit and increase thier trading capital.

With negative pressure forming on the charts anything is still possible.

But as overall trend for bitcoin price remains pretty positive, we believe institutional investors will pour money into Bitcoin Market, especially if the prices drop a bit further conform our scenario ( 5/8 retracement to 7.50K - 8.00K area to form right arm of our inverted H&S pattern. )

“Every week that passes there’s further progress and further clarity. I think more clients are starting to be very serious about how they want to have exposure to this asset class… We’re having more conversations with people you’d never think would actually have an interest who want to talk about it.”Tom Lee said;

- In our previous post / 577 / we had forecast the trading range will be between 8.750K and 9.911K. The intraday high was 9.515K and the low was 9.180K.

- The move up has slowed down considerably after yesterday's equilibrium and after we saw a couple of days ago the local top at 9.767K, based on the price action and the increased volume during the decline, supported by RSI indicator, because we saw this indicator going to 70, which is the beginning of the overbought area. The reason why we believe, the situation looks more favorable for a pull back as our scenario, because RSI got on the verge of an overbought, and if we could still see a move higher a little bit, we believe the correction towards 7.50K - 8.00K area will start in a couple of days.

- In our opinion, and we would definitely want you to know that; No Change in our forecast as we still expect after the rejection from 9.767K ( April High ) that the price will visit the 7.50K - 8.00K ( Early May ) area to build our Inverted Head & Shoulders Pattern, as we wrote in our previous post / 573 / before the continuation of the bull trend towards 12.40K, and only clear break or close above 9.911K will cancel our scenario.

Bitcoin price moved up but reversed course on elevated volume, which suggests we have just seen the local top of April at 9.767K and the chances of a decline towards our traget 7.702K is so high, so will go with slighty bearish for today.

Support 1: 8643.000 level.

Resistance1 : 9767.00 level.

Support 2: 8350.000 level.

Resistance2 : 9911.000 level.

Expected trading for today:

is between 8750.00 and 9911.00.

Expected trend for today :

Slighty bearish.

Medium Term:

Bullish.

Long Term:

Bullish.

The low of 2018:

5947.00.

The high of 2018 (BitcoinTrader's Year):

12407.00 - 13660.00 Area / Expected.

The high of 2019 (Bitcoin Holder's Year):

25000.00 level / Expected.

/ Project by @knircky & @famunger /

You must write a comment to the this post.

investing considerable time and effort up front in

hopes of considerable returns down the road.

I'm so proud of my little blog, and so grateful to all of you

for support to keep it going.