Time: 8.20 A.M. / GM+2 / 1st May 2018 – Tues.

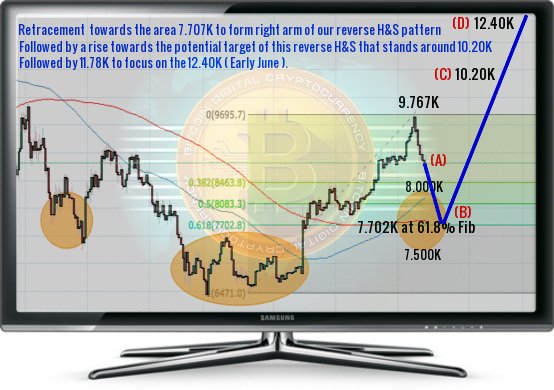

The last few days of appreciation and immediate depreciation are visible on the chart as well and 9.767K still look like a local top, as we expected on 24 April in our post / 572 /.

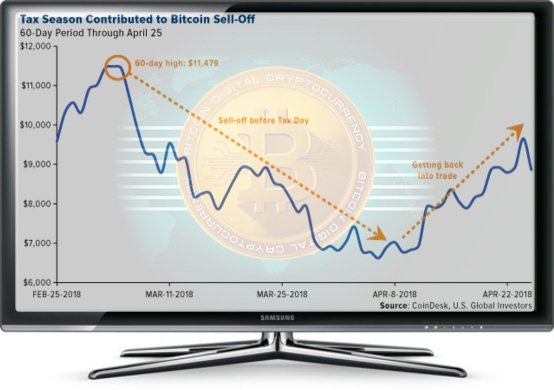

- Many bitcoin investors liquidated some of their holdings ahead of the filing deadline to cover capital gains taxes from last year and are now getting back into the trade. Month-to-date as of April 27, bitcoin was up more than 33 percent.

- Bitcoin has not been shot down but the current situation remains slighty bearish. The most important part from the long-term chart is the thing, didn’t change. But bitcoin price is still so far from breaking the important resistance levels on the move up, which suggests that even if we do see a move up, will be limited to 9.911K.

- In our previous post / 578 / we had forecast the trading range will be between 8.750K and 9.911K. The intraday high was 9.385K and the low was 8.876K.

- We see no reason to change our current scenario, as 5H is contained within a Triangle pattern (RSI = 52.372, Highs/Lows = 0, CCI = -19.7215, STOCHRSI = 48.401). Unless the High Volatility on 1H eases (ATR = 84.2071), we will keep seeing Lower Highs and Higher Lows on an intra day basis. The reason why we believe, the correction towards 7.50K - 8.00K area will start in a couple of days, and we can treating this pull back as a buy opportunity.

- No Change in our forecast as we still expect that the price will visit the 7.50K - 8.00K ( Early May ) area to build our Inverted Head & Shoulders Pattern, as we wrote in our previous post / 573 / before the continuation of the bull trend towards 12.40K, and only clear break or close above 9.911K will cancel our scenario.

Bitcoin price showed bearish action that moved the price below 9K barrier and EMA50 attempts to protect the price, while stochastic shows oversold signals. The trend for today Slighty Bearish associated Swingy Move.

Support 1: 8643.000 level.

Resistance1 : 9384.00 level.

Support 2: 8350.000 level.

Resistance2 : 9767.000 level.

Expected trading for today:

is between 8350.00 and 9384.00.

Expected trend for today :

Slighty bearish.

Medium Term:

Bullish.

Long Term:

Bullish.

The low of 2018:

5947.00.

The high of 2018 (BitcoinTrader's Year):

12407.00 - 13660.00 Area / Expected.

The high of 2019 (Bitcoin Holder's Year):

25000.00 level / Expected.

/ Project by @knircky & @famunger /

You must write a comment to the this post.

investing considerable time and effort up front in

hopes of considerable returns down the road.

I'm so proud of my little blog, and so grateful to all of you

for support to keep it going.