Thank You For Your Support and For Honoring Me With Your Up Vote...

This section has a very detailed article on how to avoid being scammed in this ruthless world of Forex. I will explain in detail six tips that you need to look for prior purchasing any products. Even though most of the time you may claim your money back,the time wasted is never returned. You should have used that time to learn how to trade! Read it!

The Forex Market in particular is full of scams. In this article I will share with you some tips which will help you identify whether the product you are purchasing is worth your time to try it or not. I will explain in detail what things to look for that will simply alert you to take extra precautions. If you are just starting out in Forex, it is extremely important to stay away from crap products since you will be learning the bad things, and indirectly these will keep haunting you in trading for years to come.

Definitely there are good legit products, but most of the time these do not get the exposure they deserve. But unfortunately what arrives in your inbox on a daily basis are mostly crap products.

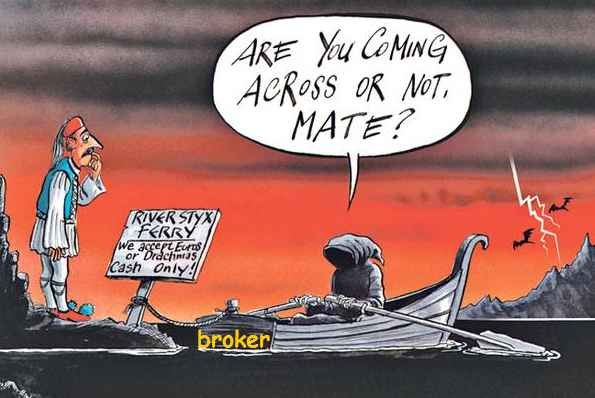

Forex Reality:

The problem is that there are people who

0.5% really sell genuine products / services.

70% sell CRAP products and they do it bluntly in a very unprofessional way,

but you still buy this crap.

29.5% sell CRAP products in a professional way.

The latter manage to build a great reputation on the internet where they portray themselves as being real traders and that they sell real profitable systems. Most often their systems are sold for over $1000. You may receive the system at home with in a nice package and all the crap, or a really sophisticated website with a number of videos and you don’t know from where to start.

Typically their blogs are full of great comments – like “I recovered the cost of the course in 2 days”, “I made $500 in my first trade”. You will also be flooded with emails saying that the system will not be anymore on sale, so buy the system now – you know this creates an urgency in you and you end up buying the system, since you think that you cannot lose the opportunity of your life – the chance to change your life. You know what I mean. And how many times have you been disappointed? I think 99% of the time. In the Forex market, it is 99% of the time, and if you are a beginner it is 100% of the time. And guess what? The system will be resold again (probably under a different name) a few months down the line. These kind of people are internet marketers and not traders and 3 names just came in to my mind right now. They sell useless systems every 2 months or so, and people like chickens buys these useless systems.

I don’t call these people scam artists, since they have a reputation to defend so they will refund your money IF YOU FOLLOW CLOSELY THEIR REFUND POLICY. So read the terms and conditions carefully. Eventually you will get refunded, but you will lose shipping cost and most importantly you will lose TIME and MONEY if you are so ‘idiot’ to trade live with their system. And normally the beginners will do trade live straight away since they are still brainwashed with the idea that this system should work, so it should be profitable. This is what they were promised. So they keep trying, they will get some good trades of course but in the long run, the system is just a failure. They lose money, they get demoralised and probably they quit trading.

Something else.. do you think that these internet marketers invented the systems themselves? No way! They found them for free in forums, did some tweaking and sold them to you for $1800 +. That’s the truth guys – sorry. And if the system is based on lagging indicators, it is nearly certain that the system will fail.

Things to look at prior you purchase of any forex robot or system:

- Refund Policy

Is there any money back guarantee in place? If so, for how long? Typically it is between 30 – 60 days from the date of purchase. Do you have time to test the system, read the ebooks or whatever you are purchasing?

With which company is the money back guarantee being offered? Ideally if it is through reliable companies like Clickbank and Plimus it would be even better. If not, make sure to read the terms and conditions and it is clearly explained what you need to do to get a refund.

The terms and conditions should be clearly written and I believe it is by law – but I stand to be corrected on this. Irrespective if it is by law or not, it should be clearly stated what you need to do to claim your money.

If it is not clearly put out for you, just close the browser.

- Impossible Claims of Profit

You know why a beginner cannot make $500 in 1 day or 2 days? Let me tell you why. Do you really believe that the market gives money this easy? If so, everyone will be rich. Even if you have the perfect trading system with precise entry and exit rules, as a beginner you may still lose money. Why? Because a good system is just 1/4 of the whole story. You need

- a good trading system

- discipline (do not get greedy, or keep looses running etc.)

- strict and effective money management

- to be able to trade without emotions

But let’s assume that the system is so perfect that it has clear entry – exit points, and your emotions play no tricks on you. And before I continue, it is by professional traders’ law that while trading you never risk more than 2% – 5% of your capital per trade.

For a newbie to make $500 he needs to trade with 1 lot per trade. So if he risks 2% of his account, and has 35 PIP stoploss, he needs an account of $18,000 capital to start off with. How come? It is simple maths – 2% of $18,000 is $360, you will be trading with 1 lot, have a stoploss of 35 pips, so potentially you may lose $350. Now as a newbie do you really have that startup account? Furthermore if you see a trade going against you, do you have the nerves to control your emotions when you see your trade being -$280, be disciplined and have the balls to close your trade with -$350 loss later if it continues to go against you? – remembering you are just starting out. I am pretty sure that you will not have the mental strength to manage your trade properly. The trade may instead go in favour of you, and make 50 pips, for $500 profit. 50 pips profit is quite possible per trade, but my point here is that for a newbie, no way you will be making $500 per trade! It is impossible! (1 lot = $10 just to keep things simple)

OK, you may argue that he may have traded with smaller lots, so lets assume that he traded with 0.1 lots – fair enough. So this guy in his very first day has earned 500 pips – wow pretty impossible. Ask any real trader and he will simply tell you to f*** off. (0.1 lot = $1 just to keep things simple)

BEWARE: Crap systems have a stoploss of over 60 + pips, so you will be risking more. And if the system has an extremely bad risk to reward ratio you are in deep trouble.

- Invented Testimonials

Another trick to be cautious of is on testimonials. If the system is brand new, how come you have valid testimonials? It is typical these days that for highly expensive systems, they create some kind of anticipation and they will start e-mailing about the system release some 3 weeks before.

On the day of release you will be bombarded with mails and messages stating that the system is live and you can now buy it. Of course they change the sales page, and here you go, you find testimonials on the page and the system has just gone live! Impossible! Do you think that these people got the system before to test it out? No way. Do not believe the crap.

Mind you, there are products with legitimate testimonials, but for this to happen the product should have been on sale for months – not just released!

Biased Reviews

It will be good to ask in forums about the product and the trader behind the product. Ask about the product, if any one has used it, and what are their views. Baby Pips forum is a great place to ask. If the product is real bad, you will notice it immediately from the comments. Sometimes however you may find conflicting information. Some people may have liked it, others not. You cannot please everyone in life, and in Forex this is even more valid, since every trader has his own trading style. So if the system is based on scalping strategy it will not go well with day traders. In this case you need to use common sense and evaluate from the comments if it is right for you or not. Remember to check always the refund policy.

It is always a good idea to see if the seller has other products for sale or if he has released other products in the past. Do the same search for reviews in forums. If you find bad reviews on the old products, what are the chances that the new product will be better? Nearly None!Crap Bonuses

Most of the times the bonuses offered with inflated values are crap. Some books even have conflicting information with the product that they are selling. You will get nuts if you read them both.

It is really funny to read about the bonuses. They may offer free bonuses that also generate money for you. “Hey, wasn’t the system I am yet to buy from you generates money as well? So why do I need another system that generates money?”

Don’t be silly to think that with the added free bonus you will have two systems which generate money for you. If you are paying good money for a system that generates money, you do not need another one! Scam – run away!Any Test Results?

If they provide test results on the sales page, do not just believe them. Evaluate the results. I know this is very difficult but at times you will find really conflicting information. Again ask in forums and get a feeling of how other people did with the product.

If you are into robots – and you definitely should stay away, do not believe back tests results. The results can be manipulated easily.

Final Note

So are there any good products out there? Yes there are but as I said they don’t get too much promotion. Also by demo trading yourself you get the feel of the market and what is going on. So by yourself you will start filtering crap products automatically.

There is nothing bad to try the product if you can’t tell if it is of value or not. Just always check the refund policy. Request a refund if it is of no value to you – simple. Of course be a gentleman and do not request a refund if the product is good.

Be careful guys. Too many sharks out there.

Every comment, every upvote, every support is really appreciated.

Thanks For Reading,

@lordoftruth

If you missed to read my

previous posts from the series of Forex Education Center

You will find it in the down list: