Our broken crony capitalist system

The party winds down

After the collapse of the Berlin Wall, the West has been celebrating the morphing of the command & control socialist/communist East into the Western capitalist system.

Russia is state capitalist.

China is party capitalist.

India has junked permit-license Raj.

While the United States was the beacon of free markets, America has been increasingly become more & more crony capitalist.

Would Adam Smith have turned in his grave if he, as we now are,

was coerced into enduring & witnessing the transformation of the

West from capitalism to socialism in our time?

Consider the following:

- The protests against the election of President Donald Trump.

- Agitations against European & North American immigration.

- The acrimonious hard & porous borders debate.

- Brexit. Occupy Wall Street.

- Venezuela's currency gymnastics.

- India's high denomination currency note demonetisation

- Famines in the Sahel.

- Open Society Founadations aspirations to remodel the world in the image of George Soros.

You too would also be able to list, ad infinitum, more horrors from your own geographies.

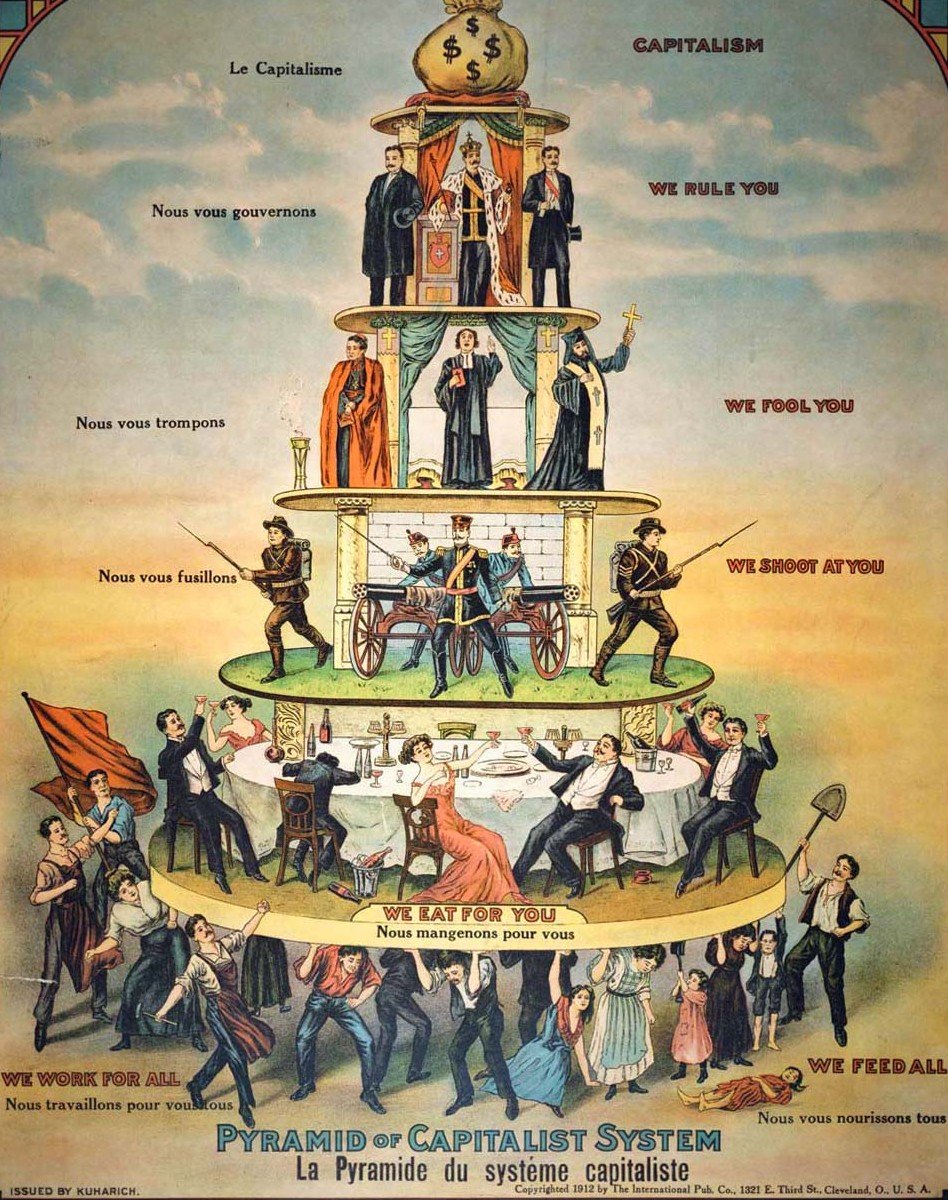

Is capitalism the ultimate pyramid scheme?

Will President Donald John Trump take the bull by the horns &

end America's economic folly?

How will Trump unleashed, in turn, lead to a metamorphisis of

capitalism as we know it?

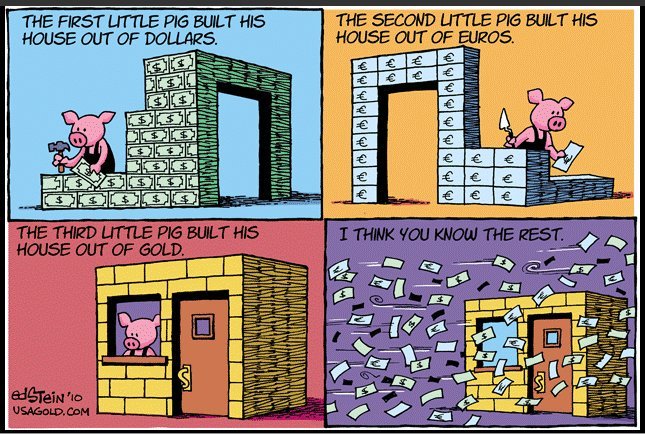

Kicking the financial can down the road

How this approaching train wreck came to pass, is a tale of Presidents, money, currency & gold. Of Roosevelt, Kennedy, Nixon & their executive orders.

Franklin Delano Rossevelt

Executive Order 6102

FDR telegraphed the terminal state of our crony capitalist economy when he confiscated gold in 1933. Though FDR ran on a plank of gold & sound money, while in office, FDR's New Deal pivoted America Left, confiscated gold & rubbished sound, honest money.

Who campaigned for a “drastic” reduction of 25 percent in federal spending, a balanced federal budget, a rollback of government intrusion into agriculture, and restoration of a sound gold currency?

Roosevelt did.

Who called the administration of incumbent Herbert Hoover “the greatest spending administration in peace time in all our history” and assailed it for raising taxes and tariffs?

Roosevelt did.

FDR’s running mate, John Nance Garner, even declared that Hoover “was leading the country down the road to socialism.”

#32 – FDR Was Elected in 1932 on a Progressive Platform to Plan the Economy

As America fleshed out the military industrial complex in World War 2, thanks to Hitler, Churchill, Stalin, Mussolini & Tojo, FDR the Keynesian icon, became the new American Caesar. Inspite of his exacerbating the Great Depression, his build-up to fight WW2 enables economists to proclaim FDR an economics genius.

John FitzGerald Kennedy

Executive order 11110

On June 4, 1963, a little known attempt was made to strip the Federal Reserve Bank of its power to loan money to the government at interest.

Rense.com

JFK demonetized US silver, as the global prices of silver soared on the back of industrial demand. Was JFK's Executive Order 11110 the first step in the elimination of the Federal Reserve?

Richard Mihous Nixon

Executive Order 6102

In the aftermath of WW2, the United States became the undisputed global economic hegemon. The architecture of Bretton Woods, the post-WW2 economic framework, was designed with the US dollar as the foundation. The US Federal Reserve was committed to backing the dollar with gold.

As the the world began catching up with America, de Gaulle pressed the United States for gold. Rather than pay out gold, Richard Nixon, temporarily dropped US dollar convertibility to gold.

Donald John Trump

My job is not to represent the world. My job is to represent the United States of America.

President Donald Trump’s first speech to Congress

As a Republican, Trump wants more free trade; but, even more, as a nationalist, he espouses fair trade. _

Fair to America._

What should Trump do?

What can Trump do?

What will Trump do?

A portrait of President Andrew Jackson, a populist conservative, who has been likened to, looks over Trump's desk. Trump himself acknowledges being inspired by Jackson.

Carpe Diem: Will Donald Trump seize a Jacksonesque opportunity?

Class warfare

Wealth as a zero sum game

As the leader of the free world, America has directed humanity, progressively down the rabbit hole: from relatively sound money to ever degrading currency.

Warren Buffett: Actually, there’s been class warfare going on for the last 20 years, and my class has won. We’re the ones that have gotten our tax rates reduced dramatically.

If you look at the 400 highest taxpayers in the United States in 1992, the first year for figures, they averaged about $40 million of [income] per person. In the most recent year, they were $227 million per person — five for one. During that period, their taxes went down from 29 percent to 21 percent of income. So, if there’s class warfare, the rich class has won.

`There’s been class warfare for the last 20 years, and my class has won’

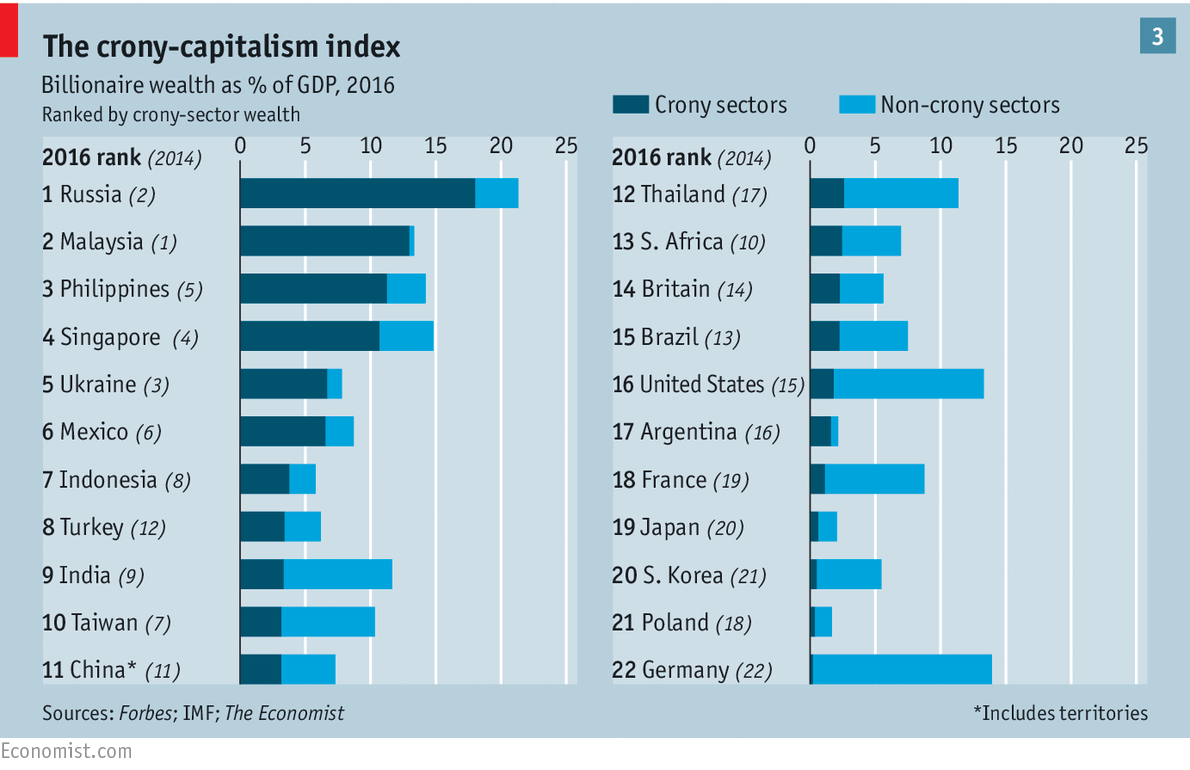

Crony capitalism is built on a quid pro quo between capital & government.

When private sector capitalism enagaged in folly,

the government was always there to lend a helping hand.

Not to end capital's folly.

National moral hazard

Inspite of the democratic governments accentuating private imprudence, the supposedly independent central banks have consistently bailed them out. As a result, of central banks bailing them out, no government today has had to factor in national trade imbalances. Academicians like Paul Krugman created an intellectual framework for this scenario out of whole cloth & won Nobel Prizes for their charades. Economics steadily lost whatever rigour, it ever had.

As the central bank creates its own measuring stick, fiat currency, by which to measure itself, it has no objective measure of value.

Since, gold is an objective measure of value, the result of Nixon's gold-dollar decoupling enabled fuzzy, subjective means of computing of national trade imbalances. An inability to evaluate the true national trade balance, freed national governments from having to pay much attention to national deficits.

Economists, the blind men & the elephant?

The Blind Men & the Elephant, a poem by John G Saxe

Further, in countries where wealth comes from rent seeking, political patronage, or what is called regulatory capture (by which the powerful uses regulation to scam the public, or red tape to slow down competition), wealth is seen as zero-sum. What Peter gets is extracted from Paul.

Someone getting rich is doing so at other people’s expense. In countries such as the U.S. where wealth can come from destruction, people can easily see that someone getting rich is not taking dollars from your pocket; perhaps even putting some in yours.

On the other hand, inequality, by definition, is zero sum.

Skin In the Game: The Thrills and Logic of Risk Taking, Nassim Nicholas Taleb

Skin in the game

Skin in the game is a term coined by....Warren Buffett referring to a situation in which high-ranking insiders use their own money to buy stock in the company they are running.

Skin In The Game Definition | Investopedia

Albert Friedberg, CEO & President, Friedberg Mercantile Group, Toronto, Canada, commodities & investment management firm.

The way to make society more equal is by forcing (through skin in the game) the rich to be subjected to the risk of exiting from the one percent.

Inequality and Skin in the Game, Nassim Nicholas Taleb

Too big to fail

Propping up dead entrepreneurial ideas

We instinctively know that if is OK for a delicatessen to fail or a dot.com to crash, why is it not OK for a Citibank or an AIG to fail? Is "too big to fail", the essence of crony capitalism?

Every business is really an experimental test of an

entrepreneurial idea.

And it can fail, as well as it can succeed.

And failure is abosultely critical to any effective &

successful learning process.

Economies really can be considered to be aggregations of

huge numbers of experimental tests of ideas.

That is the essence of entrepreneurial capitalism.

George Gilder

Deconstructing the administrative state

Trump catalyzes the urgency to look at...global imbalances......Politics is returning to the arena of macro-economics, & even fundamental economic analysis with the pendulum swinging back from capital to labour.

Roy Sebag, CEO, Goldmoney

consider that the likes of Krugman and Piketty have no downside in their existence –lowering inequality brings them up in the ladder of life.

Unless the university system or the French state go bust, they will continue receiving their paycheck.

Nassim Nicolas Taleb

Donald Trump, at the Trump Organization, is exposed to the risk of ending having his meals in a soup kitchen; not the politicians or the economists.

Carpe Diem

History doesn't repeat itself, it rhymes.

That which has been is that which will be [again],

And that which has been done is that which will be done again.

So there is nothing new under the sun.

Ecc 1:9 AMP

Just measures

A merchant, in whose hand are false and fraudulent balances;

He loves to oppress and exploit.

Ephraim said, “I have indeed become rich [and powerful as a nation];

I have found wealth for myself.

In all my labors they will not find in me

Any wickedness that would be sin.

Hosea 12:7-8, AMP

Our economic world has tethering on the precipe since 2008, is a symptom of unjust weights & measures: We have had devalued currency & made our money unsound for generations resulting in:

- Inflation that benefits the rich more than the poor.

- Trade imbalances arising because of unsound money.

- The powerful exploit the weak.

- The rich exploit the poor: the rich get richer, the poor get poorer.

- The elites arbitrage the ignorance of the dregs of society, deplorabes, and pejoratively rednecks.

Will Trump's draining the swamp include:

Gold is intrinsically money because of physics, not economic diktat.

Paper : Debt :: Gold : Savings

Economics : fiat currency :: Physics : gold money

Dark web : internet :: crypto : currency

QED

Sound, honest money

The United States v the world?

Russia & China are accumulating gold.

The dollar's share of international assets is declining relative to gold.

Central banks have on the net sold dollars & bought gold.

Does the paper matter?

Fiat v crypto v bitcoin?

The Federal Reserve is building its own blockchain.

Goldmoney enables anyone on the planet to choose their money.

Today, with President Donald J. Trump taking charge, chorus for returning America back to a gold standard is growing louder.

The game theory is not the United States versus the world

Much of the inspiration for this post came from the Goldmoney 2017 Outlook and Roundtable Discussion with:

- James Turk, Founder, Lead Director

- Roy Sebag, Director, CEO

- Alasdair Macleod, Head of Research

- John Butler, Vice President, Head of Wealth Services

As has become tradition, the Goldmoney leadership team, comprising over a century of practical, diversified financial experience, discussed their outlook for 2017 and beyond. Topics include historically unprecedented economic imbalances, the persistent demand by central banks for gold, the trend of rising inflation around the world and several other contemporary themes.

Goldmoney on YouTube

This post does not represent the views of Goldmoney, Inc or any of its officers. Kindly do your own due diligence before making any investments or financial transactions.

Do you want to help bring back, honest sound money?

And make money great again?

When you sign the petition you are

simply voting to restore your right to use gold and silver as money without impediments, as recognized by the U.S. Constitution. http://mmga.org

@goldmatters

GoldAu79

Gold is money

Gold is money

Will you let fiat currency inflation tarnish your legacy to your children?

Has Goldmoney's Aurum made the search for a central bank gold standard redundant?

The world's personal gold standard

Gold Is Money

How would you like a little gold for your birthday?

Your working world has changed forever.

Through internet marketing, you can make the internet work for you.

Even earn free bitcoin.